Review of Indian Economy & Markets - Week ended 12th September 2015

Weekly round up of Indian Economy - Week ended

12th September 2015

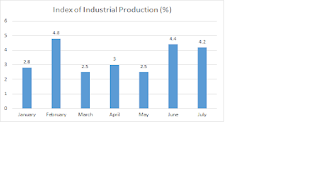

Index of Industrial Production (IIP) for the

month of July was released during this week. Industrial output recorded a

growth of 4.2% during the month July. This growth was possible due to the

growth in outputs of Manufacturing, Capital Goods and Consumer Durables

segments. Trend in IIP during from January 2015 till July is as follows

Please note that IIP for June was initially

estimated at around 3.8% but was revised later to 4.4%.

A look at the components of IIP indicates that

except for Consumer non-durables every other segment showed a good growth over

same month previous year.

- Manufacturing sector up 4.7% in July 2015 compared to 0.3% down in July 2014

- Capital good sector up 10.6% in July compared to 3% down in July 2014

- Consumer durables up 11.4% in July this year compared to 20.4% down same month last year

- Consumer non-durables down 4.6% in July 2015 compared to 5.2% up in July 2014.

It is expected the IIP continues to show good

growth in August onwards. However there is a possibility of it showing a

reduction (may be) in September - November period more particularly in Consumer

Durables sector as Rural India is reeling under near drought conditions and may

postpone consumption during the festive season.

Government approved the proposal to introduce

Gold Monetization scheme and Sovereign Gold Bond scheme during this week. The

idea of introducing such a scheme was expressed by the Finance Minister during

his budget speech. The Gold Bond scheme is expected to reduce the demand for

physical gold and the monetization scheme is expected to release physical gold

lying with Indian public to Government which in turn can sell the same to

Jewellers.

Government approved the Spectrum Trading

guidelines for Telecom Companies during this week. Spectrum is the bandwidth

leased by the Central government to Telecom companies (Telcos) to offer their

mobile telephone and other related services. By allowing the trading of spctrum

between telcos, many companies can share the same bandwidth which was not

allowed earlier. This will increase the capacity of the telcos and provide them

an opportunity to offer better services to consumers.

Coal linkages were announced to NTPC's 1320 MW Barh Thermal Power plant. This will

reduce the cost of generation of this plant by 50% to around INR 2 per unit.

The ruling party again will get into the election

mode starting from this week after the announcement of polling dates for

elections to Bihar Assembly. As the Prime Minister is the main campaigner for

the party and the Parliament is in

recess there may not be many important policy decisions during this period.

Prices of pulses continue their upward journey

unabated for quite sometime now. As per the Government of India estimates,

Arhar prices went up by around INR 50 during the April - September period while

as per the market information the prices went up by INR 30 in the last month

itself. Arhar (Red gram), Urad (Black gram) and Moong (Green gram) are ruing above Rs 130, Rs 120 and Rs 100 per kg

respectively during this week while they were at around Rs 80, Rs 82, Rs 90 per kg same period

previous year. Central Government at last took notice of the situation and

started taking corrective measures. Import of 10, 000 tonnes of Arhar and Urad

is already in pipeline and expected to reach Indian shores around third week of

September. Tenders were floated for import of another 5.000 tonnes. Instead of

a knee-jerk reaction, Government should have initiated these measures some

months back itself to reign in the prices.

Onion prices though got stabilized still ruling

at around Rs 60 - 80 per kg during this week. Mumbai and Delhi are getting

onions from Egypt and Afghanistan now. Government will be importing 1000 tonnes over and above 10,000 tonnes

planned. However the prices are expected to rule around this level till

October.

Stock Markets

Markets remained volatile during this week albeit

recovering a bit. Nifty and Sensex went up by 1.75% and 1.60% respectively

during this week. Nifty closed at 7789.30 at the end of the week. The index

managed to stay over the 100 WMA (weekly moving average) which stood at 7634.

Major gainers this week were Real Estate, Automobiles and Engineering Sectors

while FMCG, Pharma and Energy sectors were major losers during this week.

Though the markets recovered by around 1.74% this

week, they are still down from the levels at the close of August 2015. Volumes

are showing a declining trend in the last two sessions of trading and they may

expect to stay cautious for some time in the near future due to the

expectations on the outcome of Federal Reserve rate review.

Comments

Post a Comment